Sports betting has been a popular pastime for many people since the invention of paper money. It’s a form of entertainment that can be enjoyed from your living room, or from live at any major sporting event in the world! Whether you’re looking to bet on football, basketball, hockey, soccer – even golf and tennis – we are here to help. We’ve compiled a list of our favorite sports book sites as well as some helpful tips for placing bets online.

The greatest online betting platforms make it simple to bet on football, basketball, baseball, soccer, and other sports. With the development of internet sportsbooks in recent years, sports betting has gained a lot of interest in the United States.

We’ll look at the ten greatest online betting sites in the United States in this comprehensive guide, as well as what distinguishes them. We’ll also go through everything you need to know about sports betting in the US, from where it’s legal to which bets you can make. Keep reading to learn more!

We examine the top online betting sites to see where they excel and where they fall short. Here are some of the qualities we look for when determining the best online betting sites.

This is critical. The greatest sports betting sites will do everything possible to keep their customers safe while betting online. This means that the most up-to-date SSL (Secure Socket Layer) encryption must be used. Furthermore, the finest online gambling sites will be fully licensed and regulated, including offshore bookmakers. Don’t trust websites with poor reviews or look bad.

All of the greatest reduced juice online sportsbooks will provide a large selection of sports. However, there’s more to betting market than simply what sports are accessible.You want to make sure that a reputable sportsbook has a large selection of prop bets, over/under bets, parlay combinations, and other similar betting possibilities. The more options you have for how to bet, the better.

It’s difficult to compare odds between online betting houses since they differ for each game and may vary live betting.However, before a major game, make sure to shop around for the best possible odds.

The greatest online betting sites in the United States will go to great lengths to entice you to join. Welcome bonuses might be substantial, and we consider them while selecting the top internet bookmakers. We also examine these incentives’ terms and conditions.

Live betting markets are ideal for bettors who want to see the action unfold in real time. While live streams are not always simple to come by, live betting markets are critical.In-play betting opportunities are plentiful, with most top bookmakers including BetOnline, MyBookie, and Bovada having a lot of options to wager on in real time.

The best online teaser sportsbooks will have put a significant amount of effort into the digital side of their businesses. We seek for sportsbooks that provide simple desktop sites with intuitive betting features.We give more weight to mobile betting sites that let you wager from anywhere and at any time.

Some top online sportsbooks provide unique features, such as the prop builder at MyBookie. Other bookmakers have a feature called Request A Bet that allows you to chat with a bookmaker via Twitter to get specific event prices. Some bettors will appreciate any special features, especially those who enjoy their bets more riskily.

Sportsbook customers want to know that if they have an issue, they may contact the book at any time of day or night. The greatest betting firms in the United States provide at least 24/7 email and live chat customer service.A great bookmaker can be found through live chat, phone, email, and Skype.

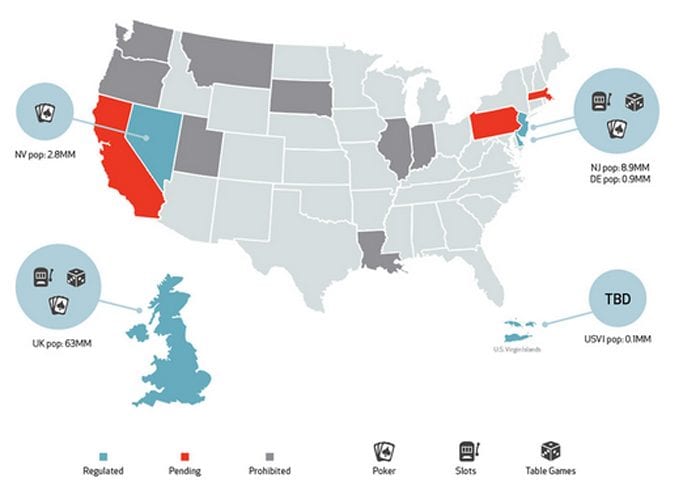

Betting on esports is legal in Nevada and New Jersey, and even moreso when you live in one of those locations. However, both Nevada and New Jersey have had their share of problems with the law. While sports betting is legal in certain states, it is not legal everywhere.Currently, only ten states have legalized internet sports betting. In 2011, the Supreme Court dismissed the federal ban on sports betting, allowing states to legalize it if they wished. US residents may have to go all around the country just to bet on athletics in certain situations.

States that are colored in green tend to allow American-owned sportsbooks, but not every sportsbook is allowed in each ‘green’ state; you’ll have to double-check to verify whether or not your chosen option is legal where you reside.

It’s for this reason that we often suggest offshore betting sites like BetUS and MyBookie. These are available, with the exception of Nevada, almost everywhere in the United States.However, it’s important to remember that offshore betting sites are not lawful in any jurisdiction – even if the state allows internet sports betting, only sites licensed by the state’s gaming commission are legitimate.

While you might think of simply betting on the winner of a game as sports betting, there’s a lot more to wager on than just the final result. Here, we’ll go through some of the most popular sports betting markets available at top online gambling sites.

A moneyline bet is a wager on which team will win a match. This is the most basic and popular type of bet at the top sports betting sites.

Prop bets are bets on events that have nothing to do with the winner of a game. A prop bet might, for example, let you wager on which team will win at halftime or which player will score the most points.s.

Under/over bets are a type of bet where you can wager on whether a certain number will be exceeded or missed. For example, you may put down an over/under bet on whether a team will score more than or fewer than X points.

In a correct score bet, you’re putting your money on the ultimate tally of a game. To win your wager, you must get each team’s score exactly right.

Futures bets are wagers on future events, not necessarily individual sports.For example, you might wager on which team will win the league championship or who will be the league MVP next season.

Parlay bets allow you to combine two or more bets into a single wager. For example, you might wager that one team will win Game A and another will win Game B. To win your bet, you must be correct with both individual bets.

In-game bets allow you to bet on a game as it happens. In response to the action, odds are updated in real time. Live betting is popular because you can watch how the match is progressing before placing a wager.

The payoff you’ll get if you win a wager is determined by the odds. The majority of US sportsbooks utilize American odds in their payouts. In this system, the underdog is denoted by a – sign and the amount required to win $100 is shown by the number after it. If the odds are -500 for a bet, you must wager $500 to win $100. The underdog is indicated by a + sign and shows the amount you’ll gain for each dollar you invest.This means that if you have $100, then you might win $250.

It’s also vital to consider the odds for any specific wager before you place it. The best bookmakers generally provide competitive odds for big matches, but when betting on events that aren’t especially popular, odds can seem quite different. Before placing a wager, compare the odds at a few of the top bookies.

To pique the appetites of bettors, the greatest online sportsbooks offer intriguing sign-up bonuses and freebies to entice new customers. The following are a handful of the most frequent sorts of offers you may come across.

Free bets are wagers that you can place for free. The name is a bit of a misnomer, however, because you must first deposit to the sportsbook and risk your own money temporarily before being able to wager on any bet.If you win the bet, you are permitted to keep your profits. If you lose the wager, the sportsbook will reimburse you for the amount you invested – so there’s no loss of money.

Free bets are bets in which you are never required to risk your own money. In fact, to begin wagering, you don’t even need to deposit money into your sportsbook account; simply sign up and the betting site will give you cash to start wagering with.If you win, you may keep the money and wager more. If you lose, you can either put cash in or depart.

The most popular welcome bonuses available at online betting sites are matched deposit bonuses. With a bonus of this sort, the amount you get is determined by how much your deposit. If you deposit $800 at BetOnline, for example, you will receive $800 in addition to it.

Wading through a lengthy list of terms and conditions may be daunting. Here are some of the most frequent bonuses-related phrases, with explanations.

You must wager through a bonus before being able to collect any winnings. Playthrough criteria might be stated as 40x, so if you bet $20, you’ll need to invest $800 in order to get your money.

When it comes to the lowest odds available for converting a bonus into cash, most bookmakers will maintain minimum odds of 1.50 to 2.00.

This is the period in which you must spend your bonus before it expires. Bonus timeframes range from 7 to 30 days, depending on the sportsbook.

The bonus amount is determined by whether you deposit in a single or double series. The higher the number, the better your chances of hitting that particular jackpot. However, keep in mind that if you deposit in a single series, you must make an initial deposit before being eligible to receive any kind of bonus.

The most you can earn from any bonus. There are limits in place to safeguard the top sportsbooks and ensure continued profitability.

With more sports betting taking place on the go, leading online betting sites have invested a lot of effort to provide players with a smooth mobile experience. There are gambling apps for both iOS and Android, as well as mobile-friendly sites accessible through your phone’s browser.

When comparing mobile betting apps, be sure that they all have the same betting markets accessible on both your phone and your desktop.It should take only a few seconds to open your bet slip, get information about future matches, and change your wagers with just a few flicks on the screen. The easier it is to place bets from your smartphone, the better.

Finding the best online Sportsbook can be a process. In our option, EveryGame is the number one choice. They have a large selection of wagering options including live betting, reduced juice, parlays, proposition bets and much more.

If you are wondering how sports betting sites work, it is similar to a casino. After you make a deposit, you can place a bet. Also, there are wagering requirements that you have to meet before you can withdraw your winnings.

Bettors will be able to select the markets on which they wish to wager, and odds for each event will be advertised. You may bet on the outcome of a single game, combine multiple bets into a parlay, or place prop bets on events that do not directly influence the outcome of a game.

There are currently 14 states that have legalized sports betting: New Jersey, Pennsylvania, West Virginia, Virginia (TN), New Hampshire and Washington,Nevada, Oregon, Colorado, Iowa, Illinois, Indiana, and Michigan.

At a US bookmaker, the odds will be shown in decimal format or as American style odds.The favorite will be indicated with a negative sign for each game line, while the underdog will be shown with a plus sign. In certain circumstances, odds are increased in order to make them more enticing to bettors.

In this type of match betting, the bookmaker handicaps a margin to disguise a disparity between the two teams.The lines are based on the point spread, therefore the favourite may be placed with a negative value of -7.5, indicating that the time is favoured by 7.5 points.