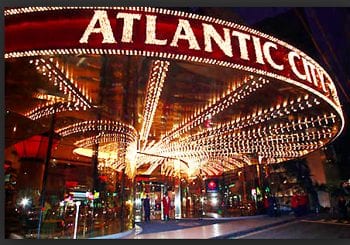

Welcome to the world’s greatest legal casino destination. NJ has a variety of games, ranging from poker and blackjack to roulette and slots. This state’s name comes from the fact that it is built along the coast, surrounded by smooth water and golden beaches. With precise directions and important information, you’ll be able to save time and money. This New Jersey casino guide delights your senses with the flavorful food, tremendous entertainment, and imitation SPA features, while any bad bet is excluded from view. In this gambling guide, we will discuss New Jersey casinos, and the following:

Major developments in taxation, gambling, and online sports betting legislation were reported last week. Here are the top stories: Mississippi Casinos slapped with tax hikes...

Read More

Gamblers in New Jersey now have access to an officially licensed online slot by Fortune Factory called NHL Gold Bliz through the BetMGM online casino....

Read More

One of Atlantic City’s biggest eyesores for the past several years has been the former Trump Plaza casino. The building was closed for good in...

Read More

We’ve shown you the finest New Jersey casino resorts, but maybe you’re simply searching for the greatest US casinos in New Jersey. We can also assist you! We’ve conducted thorough analyses and comparisons of all NJ casinos, choosing the best one based on our research.

We named the Borgata Hotel Casino & Spa the top casino in New Jersey. But why? It is, after all, NJ’s biggest casino facility. With a wide range of alternatives to choose from, it has a lot of different options for gamblers. The Borgata is distinguished by its luxurious hotel, distinctive eating spots, and top-notch entertainment.

It’s obvious that the more floor space a casino has, the more table games and slot machines it can provide to players. So, if you want to play the most different types of games, go to one of NJ’s biggest casinos.To identify the three biggest New Jersey casinos like the Borgata, we looked at area and the number of games available.

The Borgata, Harrah’s, and Caesars are the largest casino resorts in New Jersey. Each one has hundreds of gaming tables and thousands of slot machines. They also have large hotels, a variety of restaurants, and other services. You can discover more information about the state’s biggest casinos like the Borgata.

A racino is a casino with horse racing amenities housed on the same premises. In most situations, slot machines are the primary form of gambling available, although poker, blackjack, and roulette are becoming more popular.There are no racinos in New Jersey, despite the fact that the state offers a number of racetracks. Furthermore, the Borgata has poker but is not a racino.

NJ has three horse tracks. You may wager on pari-mutuel pools at Monmouth Park, the Meadowlands, and Freehold Raceway. Furthermore, in August 2021, NJ enacted a new law that allows for fixed-odds betting on horse races.There are no immediate plans to offer casino games at New Jersey racetracks, despite the fact that NJ is the first state to legalize fixed-odds betting on horse racing.

All of New Jersey’s casinos are located in Atlantic City, as you can see from our map of New Jersey casinos like the Borgata Atlantic City. This is due to the state constitution’s restriction on casino gaming only in AC.There are ten New Jersey casino hotels to pick from, all of which are available 24 hours a day, seven days a week. To make things easier for you, we’ve put up a comprehensive list of all casinos in New Jersey below.

Clearly, the best casinos in New Jersey like the Borgata Atlantic City for you will not be concerned about location. Look at the game variety, hotel facilities, and other services to identify a New Jersey casino that meets your needs. Indeed, the legal gambling age in NJ is 21. However, 18 is the legal gambling age to play bingo, bet on horses and play the lottery.

Finding the perfect peaceful hotel in Atlantic City does not have to be difficult. Welcome to Bally’s Atlantic City, a wonderful alternative for people like you looking for a place to stay while visiting the area. Enjoy world class entertainment without a cruise ship. Instead of going to the resorts spa, enjoy blackjack, roulette, bingo, Omaha,Texas Hold’em, and slots. Indeed, win cash at this casino hotel.

This luxury Borgata casino resort overlooks the marina in Renaissance Pointe and is 0.7 miles from US Highway 30 and 2.1 miles from Atlantic City’s Boardwalk. The Borgata hotel casino is the ultimate gambling destination. Furthermore, the Borgata casino have such activities like many variations of poker like Texas Hold’em, Omaha, and many more.

If you are ready to put your poker face on, enjoy bingo games and world class entertainment for real money at the Borgata hotel casino. Find the Borgata Hotel, Casino & Spa on 1 Borgata Way, in Atlantic City, NJ 08401. Also, contact the Borgata hotel casino at (609) 317-1000.

The Borgata Hotel Casino & Spa is a hotel and casino in Atlantic City, New Jersey, United States, owned and operated by MGM Resorts International. The casino hotel has 2,798 rooms and is the state’s largest hotel. The Borgata opened in July 2003 and is Atlantic City’s most profitable gaming facility.

Enjoy slots, baccarat, poker, and many more games at these casino resorts. Also, when you visit their website, you can bet on sports.

Visit the Hard Rock to play poker, blackjack, baccarat, slots, and many more poker games. Additionally, visit these casino resorts to bet on a sports game.

Find Harrah’s at 777 Harrah’s Blvd, in Atlantic City, NJ 08401.

Discover Ocean casino resorts at 500 Boardwalk, in Atlantic City, NJ 08401. Enjoy poker and many other games.

This oceanfront casino resort with a casino, spa, and restaurants is a 5-minute walk from the Steel Pier entertainment complex and a 6-minute walk from the Central Pier Arcade.The rooms at the Tromba resort offer flat-screen TVs, free Wi-Fi, mini fridges, and coffee makers. The superior rooms come with extra seats, panoramic ocean views, and marble bathrooms. A spa, a fitness center, an indoor/outdoor pool, a salon and retail outlets are all available.

At Resorts Casino hotel, you can enjoy poker, slots, blackjack, baccarat, and even sports betting. If you like Texas Hold’em Poker in Atlantic City, you may be in luck.

Locate Tropicana Atlantic City at 2831 Boardwalk, in Atlantic City, NJ 08401. Also, contact them at (609) 340-4000. At these casino resorts, enjoy Caesars slots, baccarat, Texas Hold’em, and more games for money. Also, at these casino resorts, you can bet on sports games.

Find Caesars Atlantic City Hotel & Casino at 2100 Pacific Ave, in Atlantic City, NJ 08401. Also, contact Caesars at (609) 348-4411. Have fun at Caesars resorts with poker, baccarat, slots, and more games for cash. At Caesars casino resorts, some other states can bet on sports games.

Expected New Casinos

The Hard Rock Casino, which will be built at the East Rutherford Meadowlands Racetrack, is first in line. There’s also a casino project outside AC involving Paul Fireman as part of the whole process.The casino will be part of a massive resort called Liberty National Golf Course in Jersey City, New Jersey. You may have heard it referred to as Freedom Rising. Other gambling cities in New Jersey will require a voter referendum to allow either of these new casinos to go ahead.

However, gambling concessions appear unlikely in New Jersey. NJ residents rejected a bill to allow casino gaming outside Atlantic City by 77 percent to 23 percent in a 2016 ballot measure on the topic. Given the opposition, it’s more probable than not that we’ll see new online casinos in New Jersey before any new land-based facilities open.

New Jersey has some of the most permissive gambling legislation in the Union. In New Jersey, a variety of gaming is legal. Casino gambling was legalized in Atlantic City in 1976.In 2012, the state of NJ legalized sports betting. The legislation was repealed, and the state went to court for a lengthy legal dispute that culminated in the formal opening of legal sports betting in New Jersey in 2018.

NJ is one of the few jurisdictions that allows internet casinos and poker rooms. NJ’s lottery, horse racing betting, daily fantasy sports, and charitable gaming are all legal forms of gambling. The legal gambling age in New Jersey is 21 for most products. However, you must be 18 to play the lottery. Wager on horses, or participate in bingo at Atlantic City Casinos.

Indeed, start playing real money online slots tournaments at the Borgata Atlantic City or Golden Nuggets ( has casino license) online gambling casino site for N.J. Furthermore, residents is not the only play the folks from the Garden State can play slots for real money online at the Borgata Atlantic City, on their mobile Smartphone, and on their tablets. The people that live in the Garden State can take a drive to different states like New York, Ohio, Delaware, and Pennsylvania.

Taxation of Winnings

Indeed, a 24% federal tax is charged on gambling profits in NJ, as it is in all other states. In addition, New Jersey has various additional taxes for gaming earnings. Furthermore, the Gross Income tax is one of them. Moreover, the income tax rate in New Jersey is 3%. Therefore, gambling winnings are taxed at a rate of 3% in New Jersey.

All gambling, including sports betting, casinos, and racetracks are subject to the state income tax in New Jersey. Indeed, a 3% levy is taken from winnings paid out to both residents and non-residents. Regardless, the amount of the payout is taken into account when calculating the withholding rate from lottery winnings.

In this part, we’ll look at New Jersey’s gaming regulations in greater depth. Furthermore, the gambling rules in NJ are not as tight as those in many other states. Moreover, gambling of various sorts is lawful in NJ. This includes casinos, sports betting, and internet gambling. However, gaming is subject to tight legislation in the state.

Governor Chris Christie signed Bill S-12 into law on February 1, 2011. This law gave the authority over the daily operation of casinos to the New Jersey Division of Gaming Enforcement.

Indeed, the gambling industry in NJ is good. Furthermore, NJ has many online casinos. Moreover, they are growing very quickly. New Jersey has a good plan for gambling. That said, there are few changes expected to the old laws. However, there might be small changes to the old ones. For instance, like how it runs and what it can do.

There are a total of 21 casinos and pari-mutuel facilities available in New Jersey, which are divided among ten locations across the state. Atlantic City has the most gaming establishments with 10 casinos, including the Borgata Atlantic City.

Are there dog racing / off-track betting locations in New Jersey?

In New Jersey (Atlantic City), greyhound racing is not permitted. As a result, there are no dog racing tracks or off-track betting locations where you may gamble on greyhound racing in the state. In 1934, the state of New Jersey authorized dog racing on a trial basis. The bill was struck down by the Supreme Court one year later.

Is charitable gaming offered in New Jersey?

Yes, non-profit organizations may legally operate charitable gambling. Casino nights, armchair races, bingo games, and raffles are all legal for charities. The New Jersey Legalized Games of Chance Control regulates charity gaming in the state.

New Jersey is a “lottery-free” state, which means that gambling on lottery games is not legal. In fact, it’s technically illegal under New Jersey law to gamble on lottery games in the State of Nevada ( Reno or Las Vegas). Players must begin on equal footing and take no cuts of the earnings if they engage in noncommercial gambling. Playing a family poker game or taking part in corporate football pools is permitted provided certain criteria are met. However, social gaming is prohibited in bars and other locations with drinking licenses.

The only NJ city that has casinos is Atlantic City.

As of January 2022, there are 9 casinos in NJ.

Yes, your drinks are free. You must have a total reward card and it must be inserted in the device. You may order your beverage straight from the slot machine that you’re playing. There is no boardwalk along Harrah’s…you can walk to Golden Nugget or Borgata instead.

When was casino gambling legalized in New Jersey?

In 1976, New Jersey voters authorized casino gambling after a referendum. Atlantic City is the only legal gaming site in the state of New Jersey.The New Jersey Casino Control Act was passed in 1977. Resorts Casino Hotel opened the following year, becoming the state’s first legal casino establishment.

Yes, internet gambling is permitted in New Jersey. In 2011, Raymond Lesniak sponsored a bill that was passed by the New Jersey Legislature allowing people over the age of 21 to participate in online gaming in New Jersey. NJ has licensed online poker sites, sports gambling, and Atlantic City casino resorts.

What was the first casino to open in New Jersey?

The first casino in New Jersey was a hotel with a gambling section. It opened in Atlantic City in the middle of 1978 as Resorts Casino Hotel. It was the first legal gaming facility outside Nevada, throughout the United States.

Where can I get help regarding gambling addiction?

NJ 800-Gambler is a non-profit organization that can assist you with compulsive gambling. This is a private, non-profit organization that provides referral services, education, and information to individuals impacted by gaming problems. According to New Jersey gambling rules, statutory funding for responsible gaming is $600,000 per year, plus $250,000 for each internet gaming license. This money makes sure that people in New Jersey who are affected by gambling addiction can get assistance.

What is the legal gambling age in New Jersey?

For the most part, people have to be 21 years old in New Jersey to gamble. You must be 21 or older to play casino games and wager on sports in casinos. In NJ, there are a few types of gambling that require individuals under 18. The state lottery is one example, as well as horse betting.

Yes, you may smoke in casinos in Atlantic City New Jersey. Smoking is permitted by legislation, however it is only permitted in certain areas. The New Jersey Smoke-Free Air Act allows AC casinos to designate 25% of their play zone as a smoking area.COVID limitations imposed a one-year smoking ban indoors, but it was lifted in July 2021.

Are there horse racing / off-track betting locations in New Jersey?

Yes, there are three horse racing tracks in New Jersey. The Freehold Raceway, Meadowlands Racing & Entertainment, and Monmouth Park are the state’s racetracks. Off-track betting facilities operate in the state as well. The New Jersey Racing Commission is in charge of horse racing and pari-mutuel betting in the state.